- Lifetime Solutions

VPS SSD:

Lifetime Hosting:

- VPS Locations

- Managed Services

- Support

- WP Plugins

- Concept

On Thursday, November 6, 2025, The choice made by Tesla shareholders has the potential to change the future of this company and make Elon Musk the first trillionaire in the world. The compensation package that the board is seeking the investors to approve is worth up to 1 trillion in stock options. This is a proposal that has sparked a contentious discussion on corporate governance, the power of the executives and the strategic direction of Tesla.

Tesla’s annual shareholder meeting in Austin, Texas, will determine whether to award Musk sufficient stock options that could theoretically reach $1 trillion if he meets all performance targets over a decade. This represents an unprecedented compensation proposal in corporate America and has drawn significant attention from pension funds, sovereign wealth investors, and proxy advisory firms.

The stakes are extraordinarily high. Musk has warned he may leave Tesla if shareholders reject the package, a threat that carries significant weight given his central role in the company’s vision and market valuation. The board has reacted through an offensive counterattack by initiating digital campaigns, launching video ads to rally the support of the shareholders claiming that more leadership is needed by Tesla as it shifts its business model towards an artificial intelligence and robotics firm.

Advocates of the compensation plan believe that there is a necessity to encourage Musk at the time of a significant transition. They make it an either/or offer: go with the package and get to keep visionary leadership; otherwise, there is the possibility of losing the CEO who has established Tesla as a $1.5 trillion company.

The proposal ties Musk’s compensation to ambitious operational and financial benchmarks over a decade. These targets include delivering 20 million Tesla vehicles, more than double the company’s production over the previous twelve years, achieving an $8.5 trillion market capitalization, generating $400 billion in annual adjusted EBITDA, producing one million humanoid Optimus robots, and deploying one million robotaxis in commercial operation.

Supporters emphasize that without such incentives, Musk may redirect his focus toward other ventures. “If the stock is going to go up sixfold, and that’s a requirement here, then I’m going to make a lot of money,” said Nancy Tengler, CEO and chief investment officer of Laffer Tengler Investments, a Tesla shareholder.

Importantly, if Musk achieves all targets, his voting power would increase to approximately 25 percent of Tesla, addressing his stated concerns about maintaining influence over the company’s autonomous driving and robotic initiatives.

Elon Musk with Optimus humanoid robot, confident yet thoughtful expression (Created by artificial intelligence)

Although it has the backing of the boards, the major institutional investors have come out strongly criticizing the package. The proposal was voted against by Norway sovereign wealth fund that controls 2 trillion dollars in the world and owns about 1.2 percent of Tesla. Norges Bank Investment Management was concerned with the amount of the award, dilution and absence of key person risk mitigation.

CalPERS the California Public Employees Retirement System too came out to oppose the compensation raise, with other pension funds following suit. Critics attribute this to problematic financial results of Tesla in 2025 where the company registered a reduction of 71 percent in net income and a reduction of 9 percent in revenue in the first quarter.

The shareholders were advised by prominent proxy advisory firms, including ISS and Glass Lewis, to vote against the proposal, but it was supported by Egan-Jones. In reaction, Musk referred to these advisory firms as corporate terrorists, indicating the level of emotion about the vote.

Tesla recent results present a significant challenge to the company’s growth narrative. Vehicle deliveries fell 13 percent in Q1 2025 to 336,681 units, while automotive revenue dropped 20 percent. The company attributed the decline to production line updates and market headwinds from Chinese competition and trade tensions.

Nevertheless, Tesla claims that these challenges are short-term and one of strategic change. Instead of concentrating on the sales of electric vehicles only, the management puts emphasis on the fact that the company shifts to Full Self-Driving technology and humanoid robotics. Optimus robot, which is currently a prototype, has not yet reached commercialisation, but Musk has asserted that it in the future would be able to outgrow Tesla in size in the automotive business.

The critics doubt the fact that autonomous driving of Tesla cars can really put other competitors at a disadvantage and whether the Optimus robot is capable of meeting the deployment target outlined in the compensation package of Musk.

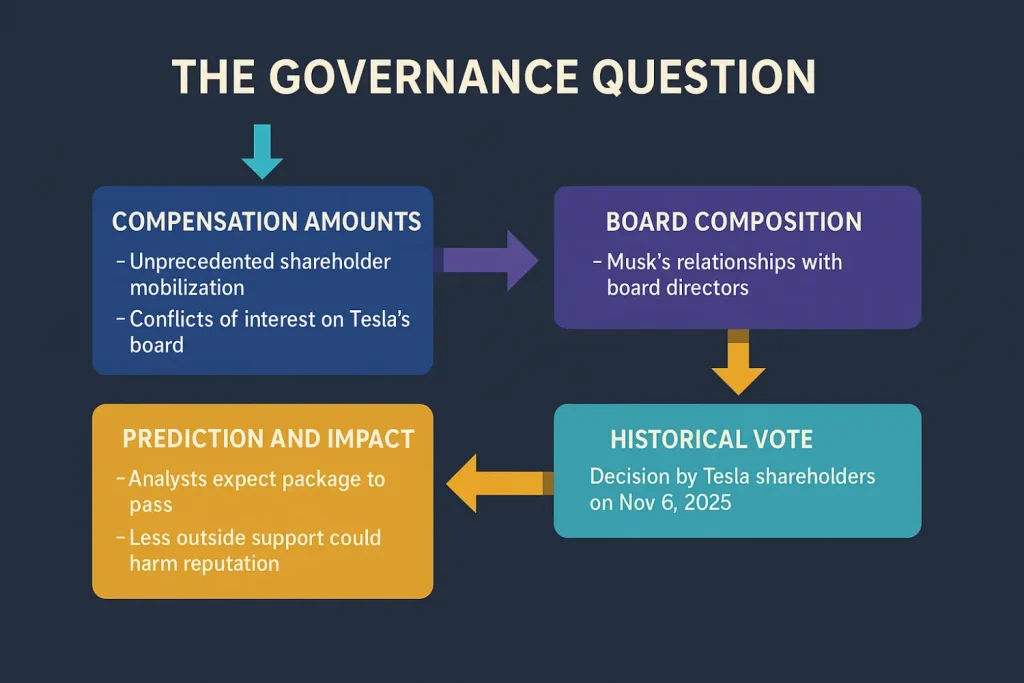

Beyond compensation amounts, governance experts highlight deeper concerns. Columbia Law School professor Dorothy Lund noted that Tesla’s unprecedented campaign to mobilize shareholder votes is unusual for a compensation decision.

Delaware courts previously invalidated Musk’s 2018 compensation package, valued at $56 billion at the time, citing conflicts of interest among board members closely tied to Musk. Tesla is appealing that decision while proposing this even larger package.

The composition of Tesla’s board, which includes Musk’s brother Kimbal, has drawn criticism from governance advocates who argue such relationships compromise objective oversight.

Market analysts widely predict the compensation package will pass, particularly since Musk can vote his own 15 percent stake. Prediction markets currently assign a 93 percent probability to approval.

However, corporate governance professor Ann Lipton warned that if the package receives less than half the votes from outside shareholders, it could damage Tesla’s reputation and the “legend of Elon Musk” that relies on perceived shareholder support.

his historical vote is a turning point in Tesla and more deep-seated issues of CEO authority, shareholder control, and pay in the biggest corporations in America. The approval of this unprecedented package by shareholders will have a significant ripple effect on the way corporate governance is carried out and conducted in the future as well as the expectations placed on executive compensation.

The decision rests with Tesla’s shareholders on November 6, 2025, a vote that will determine not just Musk’s financial future, but potentially the company’s strategic direction for years to come.

Netanel Siboni is a technology leader specializing in AI, cloud, and virtualization. As the founder of Voxfor, he has guided hundreds of projects in hosting, SaaS, and e-commerce with proven results. Connect with Netanel Siboni on LinkedIn to learn more or collaborate on future projects.