- Lifetime Solutions

VPS SSD:

Lifetime Hosting:

- VPS Locations

- Managed Services

- Support

- WP Plugins

- Concept

The Israeli cybersecurity industry has delivered one of its strongest performances in a decade, withtotal investments reaching $4.4 billion across 130 funding rounds in 2025, a 9% increase from 2024. Yet the headline figures mask a more fundamental shift: global venture capital, particularly American, now leads Israeli cyber investments, displacing Israeli domestic investors who historically dominated the ecosystem.

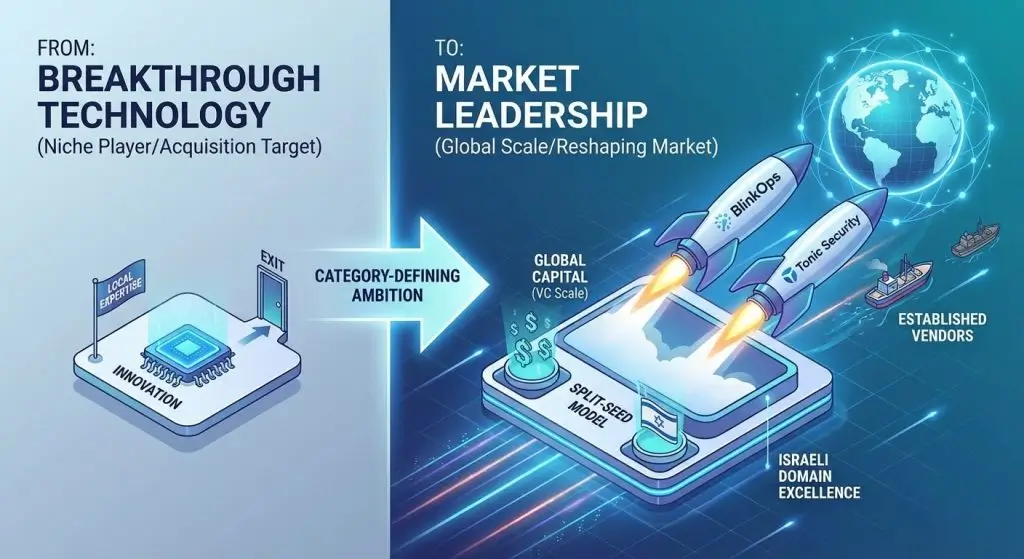

The change is not only in the distribution of capital but also in the form of Israeli cybersecurity relations with the world markets. Israeli cyber investments have become dominated by American venture capital on all fronts, with the leading funds, including Sequoia, Mayfield, Greylock, and General Catalyst, taking seats in Israeli start-ups as well as in traditional domestic ones. A hybrid of global capital and local cybersecurity expertise, this split-seed model has gained growing popularity, providing Israeli founders with insider-level knowledge in their domain along with the scale-driven capital of Silicon Valley.

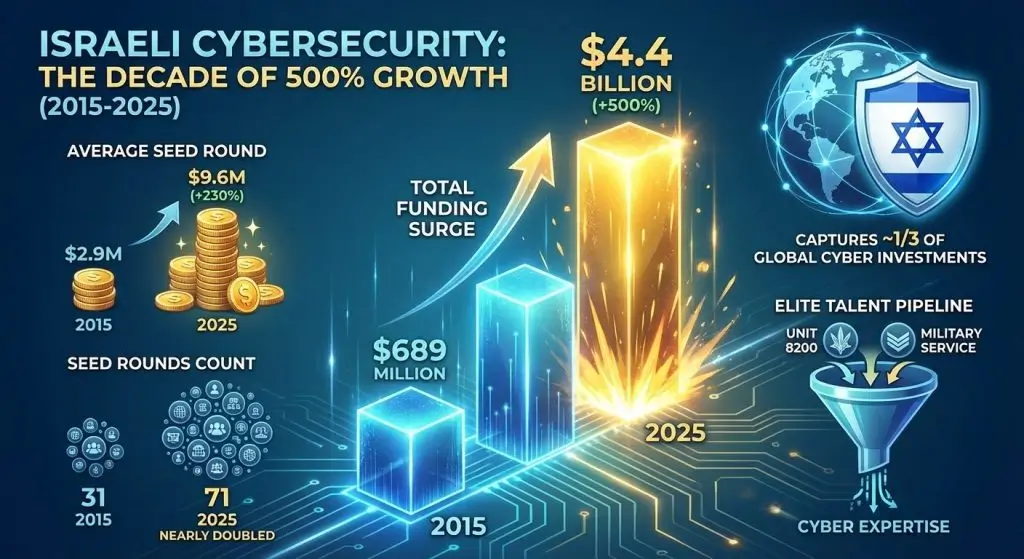

The 2025 surge is distinguished not by larger individual deals but by an unprecedented breadth of early-stage capital formation.Seed rounds reached 71, up 97 percent, with average seed round sizes reaching $9.6 million, reflecting renewed founder ambition and investor confidence.

Series A rounds numbered 33 and Series B 17, both representing significant increases over previous years. Series A rounds averaged $33.1 million while Series B averaged $54.6 million, demonstrating that Israeli cyber companies are scaling rapidly once they achieve product-market fit.

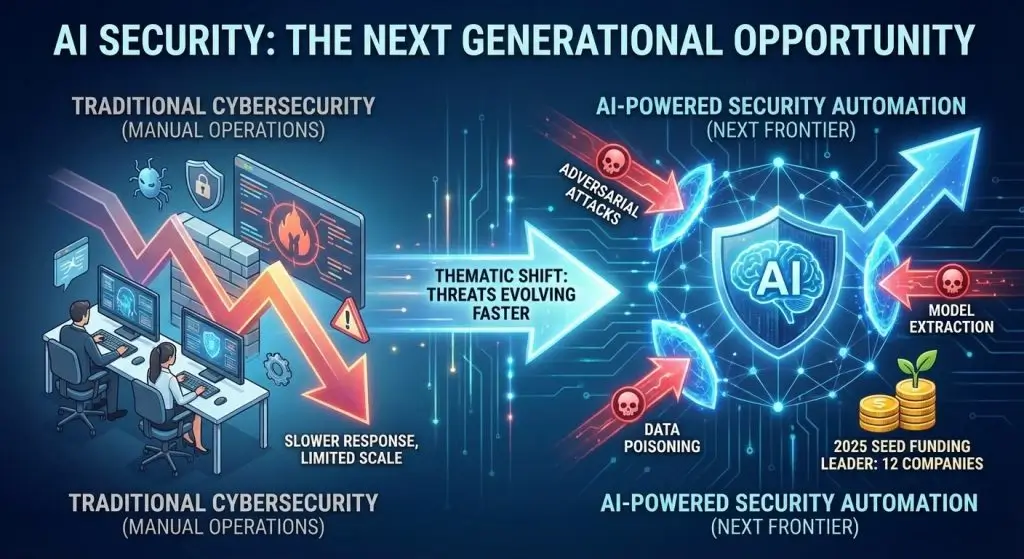

The driving force behind this early-stage explosion is artificial intelligence security. Security for AI-led seed funding, with 12 companies making it the hottest category for new company formation. Vulnerability and risk management dominated overall funding, whileendpoint security surged with 11 funding rounds, reflecting investor focus on securing AI systems and managing emerging threat landscapes.

Although the 2025 seed and pre-idea activity were in the spotlight, the 2021 investment environment is still primarily defined by two gigantic acquisitions that reshaped market values. Wiz was acquired by Google for $32 billion, marking the largest deal involving an Israeli-founded company and the largest cybersecurity M&A transaction in history. CyberArk was subsequently acquired by Palo Alto Networks for $25 billion, establishing the second-largest Exit in Israeli history.

These two transactions accounted for 98% of the total Exit value in 2025 and 70% of all value realized since 2019, creating a distorted picture of the underlying market dynamics. Excluding the Wiz and CyberArk deals, the value of M&A deals and IPOs doubled. The implication is the suggestion that mega-exits can and should take center stage, but the overall ecosystem of mid-sized acquisitions is propelling sustainable value creation.

At the growth stage, while deal volume remained limited, funding intensity surged dramatically. Nine late-stage transactions totaled nearly $1.9 billion, with growth-stage rounds averaging $234.9 million per round, reflecting investor confidence in Israeli cyber companies’ ability to scale to global dominance.

This capital fueled not only organic expansion but also an unprecedented wave of Israeli-on-Israeli acquisitions. A record 12 acquisitions of Israeli startups were recorded, with growth-stage giants such as Cato Networks, Cyera, Pentera, and Armis leveraging capital for inorganic expansion, acquiring early-stage technologies to strengthen competitive positions in emerging security categories.

Cases of quick consolidation indicate the degree of market rivalry: Base44 was bought by Wix only around the year of its establishment, and Aim Security was acquired by Cato Networks before reaching the age of three, which shows a tendency of the market for already well-established Israeli cyber companies to buy emerging technologies with potential and consolidate their market presence.

The composition of dealmakers has shifted dramatically over 2025. American acquirers dominated with 43 deals constituting 51%, compared to 31 deals in 2024. This continued American dominance obscures a parallel trend: 30 Israeli-to-Israeli transactions recorded in 2025, compared with 15 last year, constituting 35% of total transactions and $1.9 billion in transaction value.

This two-fold trend demonstrates an emerging market: American strategic acquirers are ongoing to buy Israeli technologies to scale and global distribution power, whereas Israeli scale-ups are solidifying disjointed early-stage innovation within the local ecosystem. This forms a dual Exit situation as founders can follow American strategic selling or domestic consolidation, optimizing on the various financial and operating results.

The 2025 figures must be understood within a decade-long context. From 2015 to 2025, total funding rose more than 500 percent, from $689 million to $4.4 billion, establishing Israel as the dominant global source of cybersecurity innovation capital. Average seed rounds increased more than 230 percent, from $2.9 million to $9.6 million, while the number of seed rounds nearly doubled, from 31 to 71.

This pool of capital, skills and knowledge base of the fields has fundamentally redefined the international cybersecurity markets. The startup ecosystem of Israel now gathers around one-third of all total worldwide private investment in cybersecurity, which is a focus of innovation that is by far larger than the startup ecosystems in other countries. The pool of talent, based on the compulsory military conscript in Israel, and the specialized Unit 8200 intelligence service, results in a funnel of cyber talent not found anywhere in the world.

The thematic change to AI security shows that the market has acknowledged that cybersecurity threats are changing rapidly beyond the conventional defense capability to handle them. The signal of AI-led seed investment in 12 companies in 2025, which reflects investor confidence in protecting AI models against adversarial attacks and data poisoning, and model extraction as the next phase in security innovation.

These metrics confirm the investor hypothesis that AI-powered security automation will be capable of yielding efficiency benefits and higher-quality threat detection services than traditional manual security operations.

Entrepreneurs are now founding companies that, from their inception, aspire to lead the most innovative categories on a global scale, reshaping the global security market. This ambition is reflected in the funding strategy and founder positioning. Firms such as BlinkOps and Tonic Security are not setting themselves up to be niche market or acquisition targets; they are literally establishing themselves to be globally competitive with established vendors of security services.

Split-seed models combining global capital with local expertise enable founders to pursue both venture scale and Israeli domain excellence, creating a new generation of globally competitive Israeli cybersecurity leaders.

Although the performance of the ecosystem in 2025 was strong, there are structural issues that mar the future of the ecosystem. Although numerous corporations are basing their business in the talent unique to Israel, a larger number of entrepreneurs and managers are already moving their operations to foreign countries, with the number of Israel-based companies finding it much easier to locate their headquarters in the United States or other marketplaces.

The geopolitical environment, marked by ongoing regional conflicts and anti-Israel sentiment in some sectors, creates headwinds for Israeli companies seeking global adoption, particularly in sensitive sectors like critical infrastructure protection. However, 2025 figures indicate that technological brilliance and capacity to provide solutions at the top of the market, nonetheless, keep global capitals and clientswitho the company regardless of geopolitical risks.

The 2025 performance of the Israeli cybersecurity industry is not an endpoint, but a turning point towards a new developmental stage. The fact that the growth of seed-stage activity, the dominance of global venture capital, and the creation of AI security as a category-defining opportunity all indicate that the next decade of Israeli cybersecurity innovation will be as transformative as the last one.

Israeli cybersecurity now operates at unprecedented scale and pace, with the question no longer how much Israeli cybersecurity companies can scale, but how fast. The decade-long, 500% funding increase has created a self-reinforcing cycle: global venture capital now recognizes Israeli cybersecurity as a proven category, fueling further capital inflows that attract top founders and accelerate innovation cycles. Whether this advantage proves sustainable or becomes diluted as other nations develop competing ecosystems remains to be seen, but 2025 data suggests that Israeli cybersecurity’s global dominance is likely to extend at least through the current decade.

Netanel Siboni is a technology leader specializing in AI, cloud, and virtualization. As the founder of Voxfor, he has guided hundreds of projects in hosting, SaaS, and e-commerce with proven results. Connect with Netanel Siboni on LinkedIn to learn more or collaborate on future project.